Understanding Roof Insurance Claims: A Comprehensive Guide

Introduction to Roof Insurance Claims

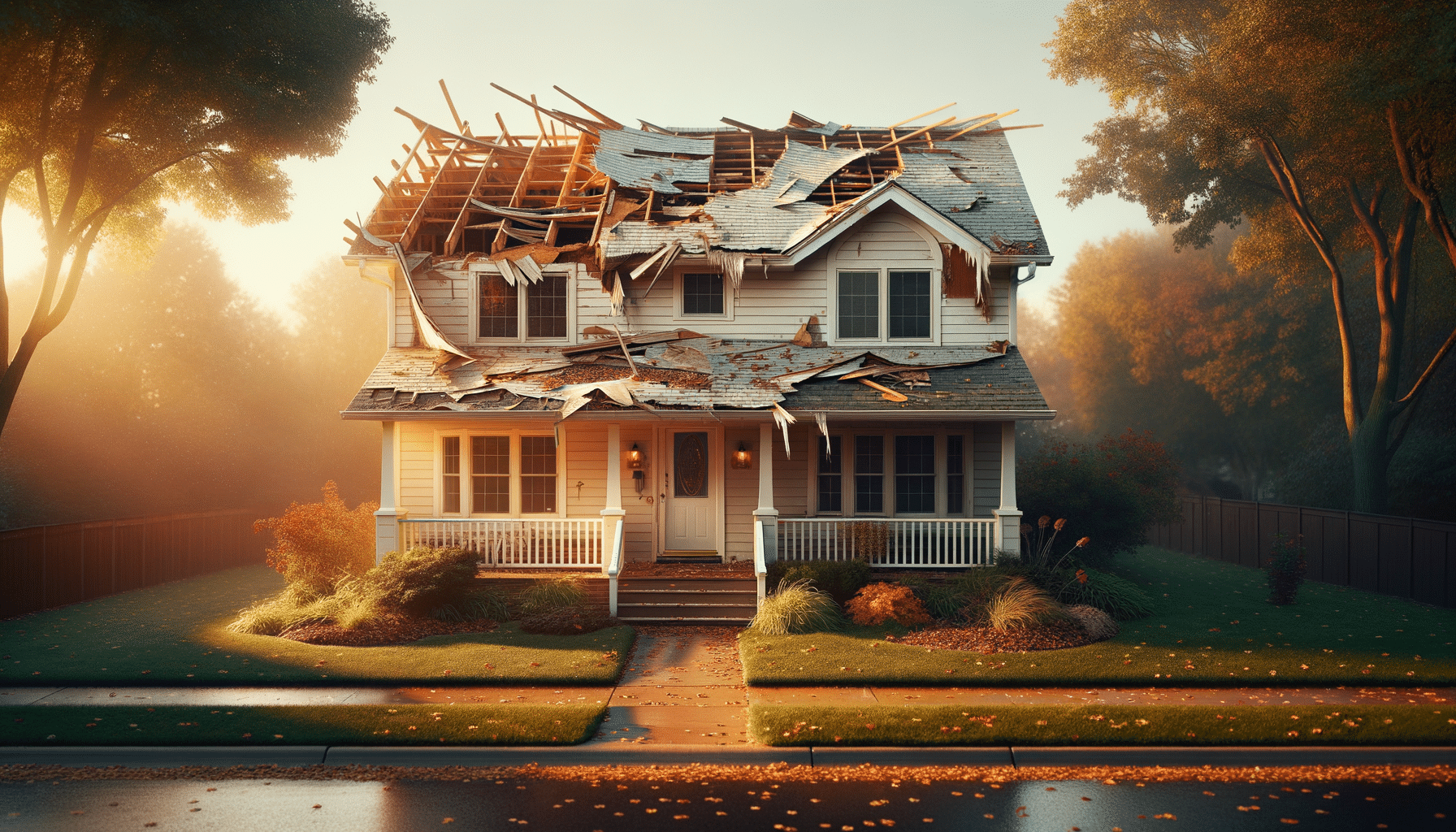

When it comes to protecting your home, the roof is one of the most critical components. It shields your family and belongings from the elements, but what happens when it suffers damage? Understanding the intricacies of roof insurance claims is essential for homeowners who want to ensure they receive the necessary financial support to repair or replace their roofs.

Filing a roof insurance claim can seem daunting, but it is a vital process that can save you from significant out-of-pocket expenses. This guide delves into the key aspects of roof insurance claims, including coverage, damage assessment, claims process, the role of adjusters, and policy considerations. By grasping these elements, homeowners can navigate the claims process with confidence and ensure their homes remain safe and secure.

Understanding Coverage

Insurance coverage is the foundation of any roof insurance claim. Coverage varies significantly depending on your policy, but generally, it includes protection against events like storms, hail, and wind damage. However, understanding what is covered and what is not is crucial. For instance, many policies do not cover damage due to wear and tear or lack of maintenance.

When reviewing your policy, pay attention to the specific terms and conditions related to roof coverage. Some policies might have exclusions for certain types of materials or specific weather conditions. It’s wise to discuss these details with your insurance provider to ensure clarity on what your policy covers.

Additionally, consider the type of coverage you have: actual cash value or replacement cost value. Actual cash value takes depreciation into account, while replacement cost value covers the cost of repairing or replacing the roof without considering depreciation. Understanding this distinction can significantly impact the amount you receive in a claim.

Assessing Roof Damage

Before filing a claim, it’s important to assess the extent of the damage to your roof. This step involves a thorough inspection, which can be done by a professional roofer or an insurance adjuster. Identifying the type of damage—whether it’s from hail, wind, or other factors—will help determine the appropriate course of action.

Documenting the damage is crucial. Take clear photographs and notes detailing the damage, as this will be invaluable when filing your claim. Include images of the entire roof and close-ups of the affected areas. Additionally, note any interior damage caused by leaks or water infiltration.

In some cases, the damage may not be immediately visible. Subtle issues like minor leaks can escalate over time, leading to more significant problems. Regular inspections can help identify these issues early, allowing you to address them before they worsen.

The Claims Process

Once the damage is assessed, the next step is to file a claim with your insurance company. This process typically involves contacting your insurer, providing detailed information about the damage, and submitting the necessary documentation.

It’s essential to be thorough and accurate when providing information. Include your policy number, the date of the damage, and a detailed description of the damage. Attach the photographs and notes you took during the assessment to support your claim.

After submitting your claim, an adjuster will likely be assigned to assess the damage further. This professional will visit your property to verify the extent of the damage and determine the amount the insurance company will pay. Cooperating with the adjuster and providing access to the damaged areas is crucial for a smooth process.

The Role of Adjusters

Insurance adjusters play a pivotal role in the roof insurance claims process. They are responsible for evaluating the damage, determining the cost of repairs, and ensuring the claim aligns with the policy terms. Adjusters act as intermediaries between the homeowner and the insurance company, providing a fair assessment to facilitate the claims process.

When working with an adjuster, clear communication is key. Be honest and transparent about the damage and provide any additional information they may need. Adjusters are trained to spot inconsistencies, so maintaining open communication will help ensure an accurate evaluation.

After the adjuster’s assessment, they will submit their findings to the insurance company, which will then decide on the claim payout. Understanding the adjuster’s role and cooperating with them can lead to a more favorable outcome for your claim.

Policy Considerations

Understanding your insurance policy is crucial when dealing with roof claims. Policies can vary significantly, and being aware of the specific terms and conditions can prevent surprises during the claims process. Consider factors such as deductibles, coverage limits, and any exclusions specific to your roof.

Review your policy regularly and make any necessary updates to ensure it meets your needs. Changes in your home’s value, the age of your roof, or local building codes could affect your policy requirements. Staying informed and proactive can prevent potential issues down the line.

Additionally, consider the benefits of bundling your home insurance with other policies, such as auto insurance, to potentially receive discounts and streamlined coverage options. By understanding your policy and making informed decisions, you can ensure comprehensive protection for your home.

Conclusion: Navigating Roof Insurance Claims with Confidence

Roof insurance claims are a vital aspect of homeownership, providing financial protection when unexpected damage occurs. By understanding the coverage, assessing damage accurately, and navigating the claims process effectively, homeowners can safeguard their investments and maintain the integrity of their homes.

Clear communication with insurance adjusters and a thorough understanding of your policy are essential components of a successful claim. Regularly reviewing your policy and staying informed about potential changes can help ensure you have the right coverage for your needs.

In conclusion, while the process of filing a roof insurance claim may seem complex, being well-informed and prepared can make a significant difference. By following the guidance outlined in this article, homeowners can approach roof insurance claims with confidence and peace of mind.