Understanding Classic Car Insurance: Coverage and Benefits

Introduction to Classic Car Insurance

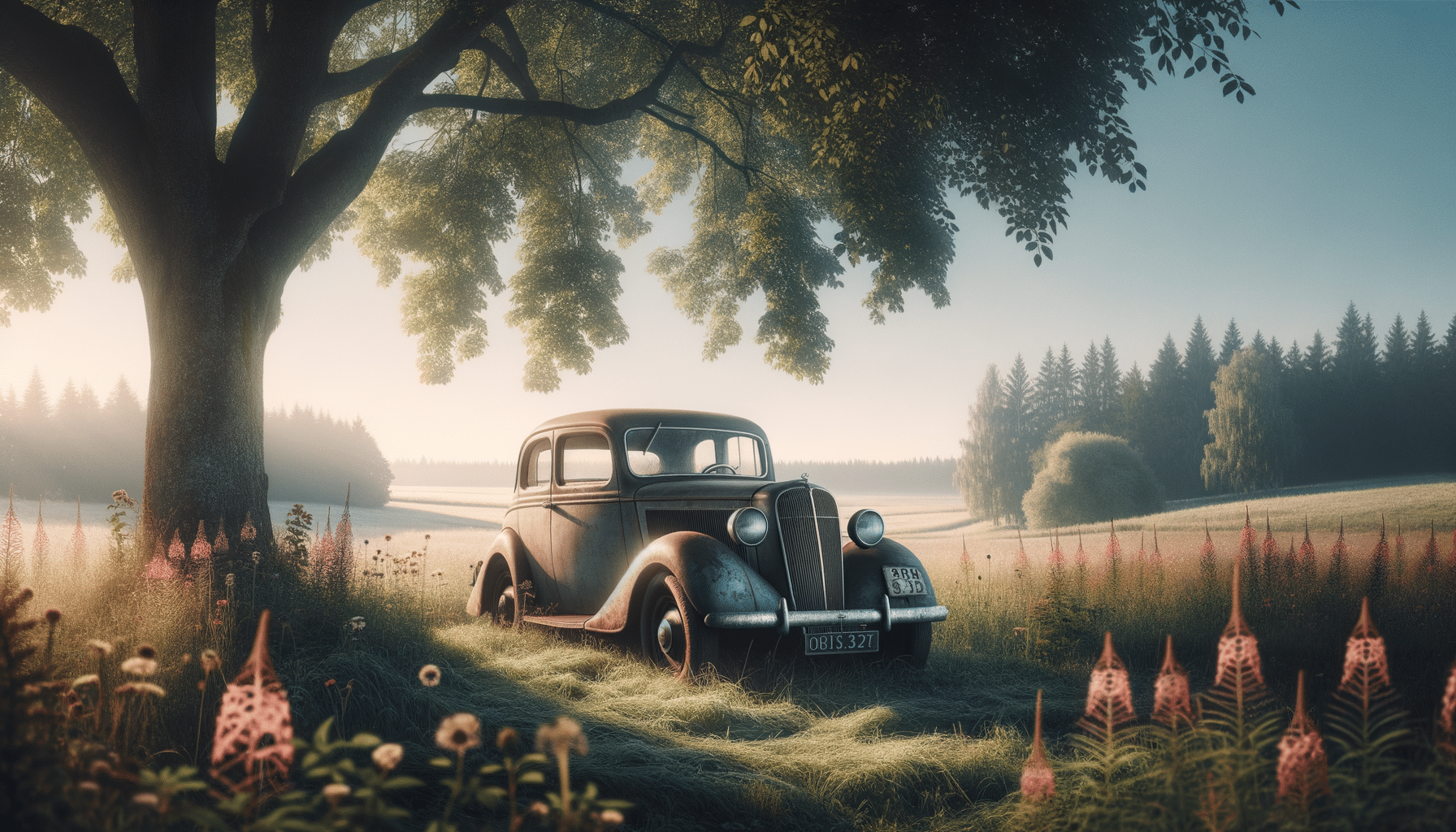

Classic car insurance is a specialized type of coverage designed to protect vehicles that are considered classic, vintage, or antique. Unlike standard auto insurance policies, classic car insurance takes into account the unique value and usage of these cherished vehicles. Drivers who own classic cars often participate in car shows, parades, and other events, which requires a different approach to insurance. Understanding the nuances of classic car insurance is essential for ensuring that your prized possession is adequately protected.

Classic cars are not just modes of transportation; they are pieces of history and art that hold significant sentimental and monetary value. This type of insurance acknowledges these factors and provides tailored coverage options. For owners, obtaining the right insurance is crucial to protect their investment and enjoy their vehicles without worry. The importance of classic car insurance lies in its ability to offer coverage that reflects the true value and usage of these unique automobiles, which is often not possible with a standard policy.

What Qualifies a Vehicle for Classic Car Insurance?

Not every old vehicle qualifies for classic car insurance. Insurers have specific criteria to determine eligibility, which often includes the age of the car, its condition, and its usage. Generally, a car needs to be at least 20 to 25 years old to be considered a classic. However, the definition can vary between insurers, with some recognizing cars as classics based on their historical significance or rarity.

Another critical factor is the vehicle’s condition. A classic car must typically be in good working order and maintained to a high standard. This ensures that the vehicle is being preserved and not subjected to everyday wear and tear that could compromise its value. Additionally, usage plays a significant role; classic car insurance is usually intended for vehicles that are not used as primary transportation. Insurers may require that the car is only driven a limited number of miles per year, often stipulating that it is stored in a secure location when not in use.

These criteria ensure that classic car insurance policies are reserved for vehicles that truly meet the characteristics and lifestyle of classic car ownership. Meeting these requirements can often lead to more favorable insurance rates, as the risk associated with these vehicles is generally lower than with everyday cars.

Coverage Options and Benefits

Classic car insurance offers a range of coverage options that are tailored to the specific needs of classic car owners. One of the primary benefits is the agreed value coverage. This means that the insurer and the policyholder agree on the car’s value at the start of the policy, ensuring that the owner receives the full agreed amount in the event of a total loss. This is a significant advantage over standard auto policies, which typically only cover the actual cash value of the vehicle.

Additional coverage options include spare parts coverage, which protects the owner against the loss or damage of rare and expensive parts that are often hard to find. Many policies also offer coverage for tools and accessories, as well as roadside assistance tailored to classic cars. This specialized roadside assistance can be invaluable, as it ensures that your vehicle is handled with care by professionals who understand the intricacies of classic cars.

Furthermore, classic car insurance often includes coverage for participation in car shows and exhibitions. This protects the vehicle while it is being displayed or transported to events, offering peace of mind to owners who frequently showcase their cars. The comprehensive nature of these policies makes classic car insurance an attractive option for collectors and enthusiasts alike.

Comparing Classic Car Insurance to Standard Auto Insurance

While both classic car insurance and standard auto insurance serve the fundamental purpose of protecting vehicles, they differ significantly in terms of coverage and cost. Standard auto insurance is designed for vehicles that are used regularly and depreciate over time. These policies typically cover the actual cash value of the vehicle, which decreases as the car ages and accumulates mileage.

In contrast, classic car insurance is tailored to vehicles that are often appreciating assets. The agreed value coverage ensures that the policy reflects the car’s true market value, which can increase over time due to factors like rarity and historical significance. This makes classic car insurance more suitable for vehicles that are not driven frequently and are maintained in pristine condition.

The cost of classic car insurance can be lower than standard auto insurance, provided the vehicle meets the criteria set by the insurer. This is because classic cars are usually driven less frequently and are meticulously maintained, reducing the risk of accidents and claims. However, the specialized coverage and benefits of classic car insurance make it a worthwhile investment for those who own and cherish classic vehicles.

How to Choose the Right Classic Car Insurance Policy

Choosing the right classic car insurance policy involves understanding your specific needs and evaluating different insurers and their offerings. Start by assessing the value of your classic car and considering how you use it. This will help determine the level of coverage you require and whether additional options like spare parts coverage are necessary.

Research various insurance providers and compare their policies. Look for insurers with a strong reputation in the classic car community, as they are more likely to offer tailored coverage and excellent customer service. Pay attention to the terms and conditions of each policy, including mileage limits and storage requirements, to ensure they align with your lifestyle and usage.

Finally, consider the cost of the policy relative to the coverage offered. While price is an important factor, it should not be the sole determinant. The value of having comprehensive coverage that truly protects your classic car is invaluable. By carefully evaluating your options, you can find a policy that offers peace of mind and allows you to enjoy your classic car to the fullest.